mississippi state income tax phone number

For specific telephone numbers. Withholding Income Division 601 923-7088.

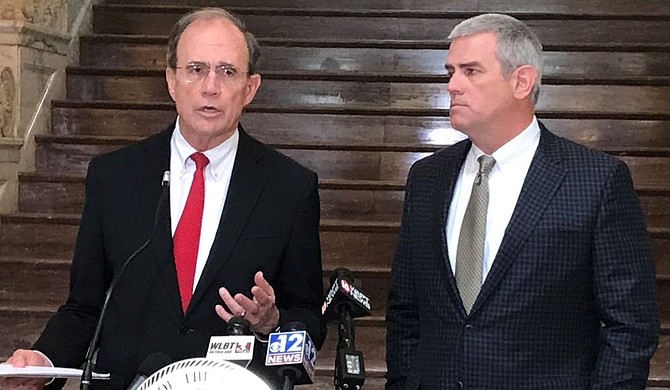

Mississippi Legislators Revive Talk Of Getting Rid Of Income Tax Localmemphis Com

Fill Out a Form W-4 - Basic.

. What can cause a delay in my Mississippi refund. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or. The Unemployment Insurance Tax program is part of a national program administered by the US.

If you are receiving a refund PO. Make a Tax Payment. Form W-4 Tax Withholding Form W-4 Tax Withholding.

If for some reason you dont want to apply online there are a few alternative application strategies you can use. Box 23050 Jackson MS 39225-3050. MCA 27-3-83 4 Taxpayers who do not have the ability to file electronically may be relieved of this.

SBAgovs Business Licenses and Permits Search Tool. However you may be. South Pointe Building Plaza.

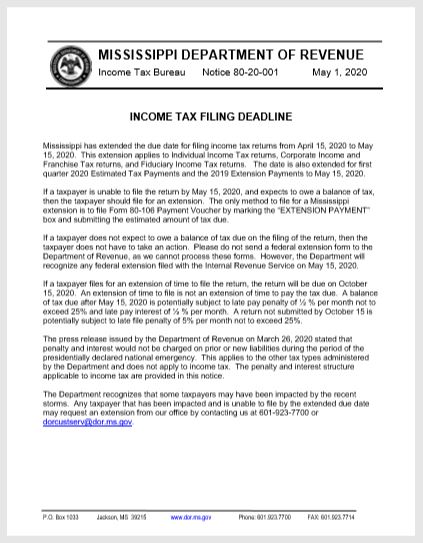

If you need more. And you are not enclosing a payment then use this address. Mississippi Department of Revenue issues most refunds within 21 business days.

The program provides temporary payments. After that you are subject to a penalty of 500 each time you fail to file as required. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Details on how to only. Apply for a Mississippi Tax ID by Phone Mail or Fax. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Based on this you can calculate your tax refund. Box 23058 Jackson MS 39225-3058.

All other income tax returns p. And you are enclosing a payment then use this address. Mississippi Department of Finance and Administration.

There are a number of things that could cause a delay in your Mississippi refund. W-4 Form Basic - Create Sign Share. Box 1033 Jackson MS 39215-1033 Physical.

See the tap section for more information. All other income tax returns P. The Mississippi Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

The Department of Revenue is the primary. And you are filing a Form. You will need your Social Security Number to get information about your refund.

Here is a look at the income tax brackets for the state of Mississippi based on filing status. Department of Labor under the Social Security Act. 5 on all taxable income.

To see if your state tax return was received you can check with your states revenue or taxation website. 900 highway 19 south meridian ms 39301. Mississippi State Income Tax Number.

500 Clinton Center Dr. If you live in Mississippi. Contact Information for District Offices and Service Areas Registration - for New Tax Accounts Statewide and Out-of-State Mailing Address.

Taxpayers that reside have a business or whose records are located in Hinds County have until February 15 2023 to file individual income tax returns corporate income and franchise tax. For information on your tax refund 24 hour refund assistance is available touchtone phones only. See reviews photos directions phone numbers and more for.

The Federal or IRS Taxes Are Listed. You may check the status of your refund on-line at Mississippi Department of Revenue.

Mississippi House Panel Oks Bill To Phase Out Income Tax Jackson Free Press Jackson Ms

Eliminating The Income Tax Would Harm Mississippi S Working Families Widen Inequities

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Mississippi Ranks 30th In 2022 Tax Foundation State Business Tax Climate Index Mississippi Politics And News Y All Politics

Form 80 170 Mississippi Resident Amended Individual Income Tax Return Youtube

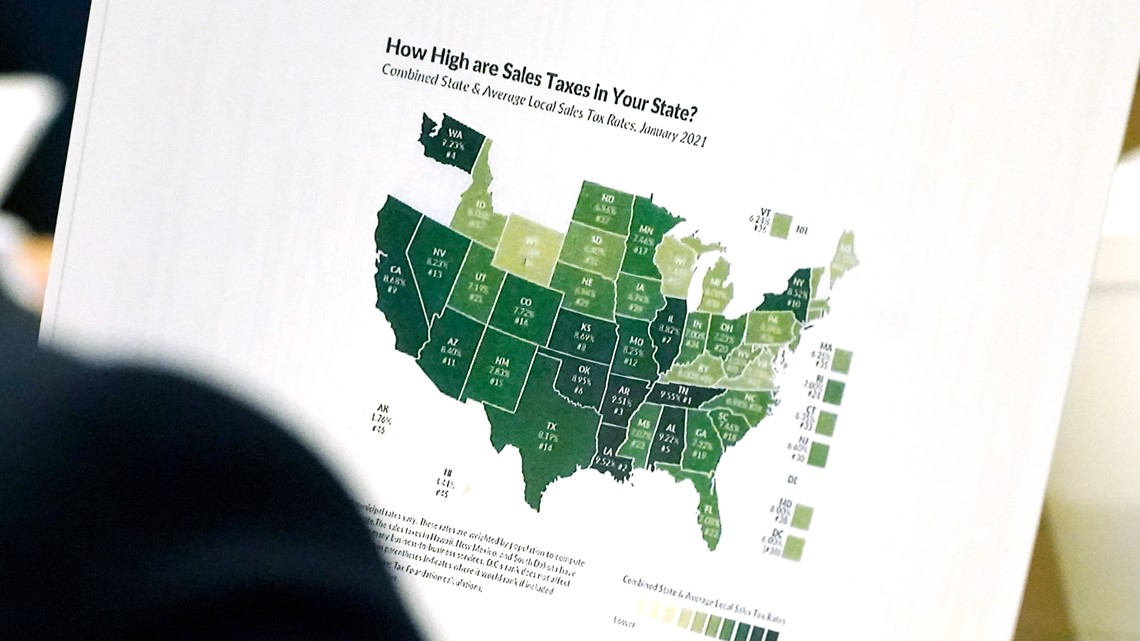

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Mississippi Good News For Residents Of Mississippi Lawmakers Pass State S Largest Ever Income Tax Cut The Economic Times

How To File And Pay Sales Tax In Mississippi Taxvalet

Philip Gunn S Plan To Cut Mississippi Income Taxes Ready For Vote

Free Mississippi Tax Power Of Attorney Form 21 002 Pdf Eforms

Will Mississippi Join The No Income Tax Club

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

States With The Highest Lowest Tax Rates

Bill Would Eliminate Mississippi State Income Tax Here S What You Need To Know State Government Djournal Com

Mississippi Governor Signs State S Largest Income Tax Cut

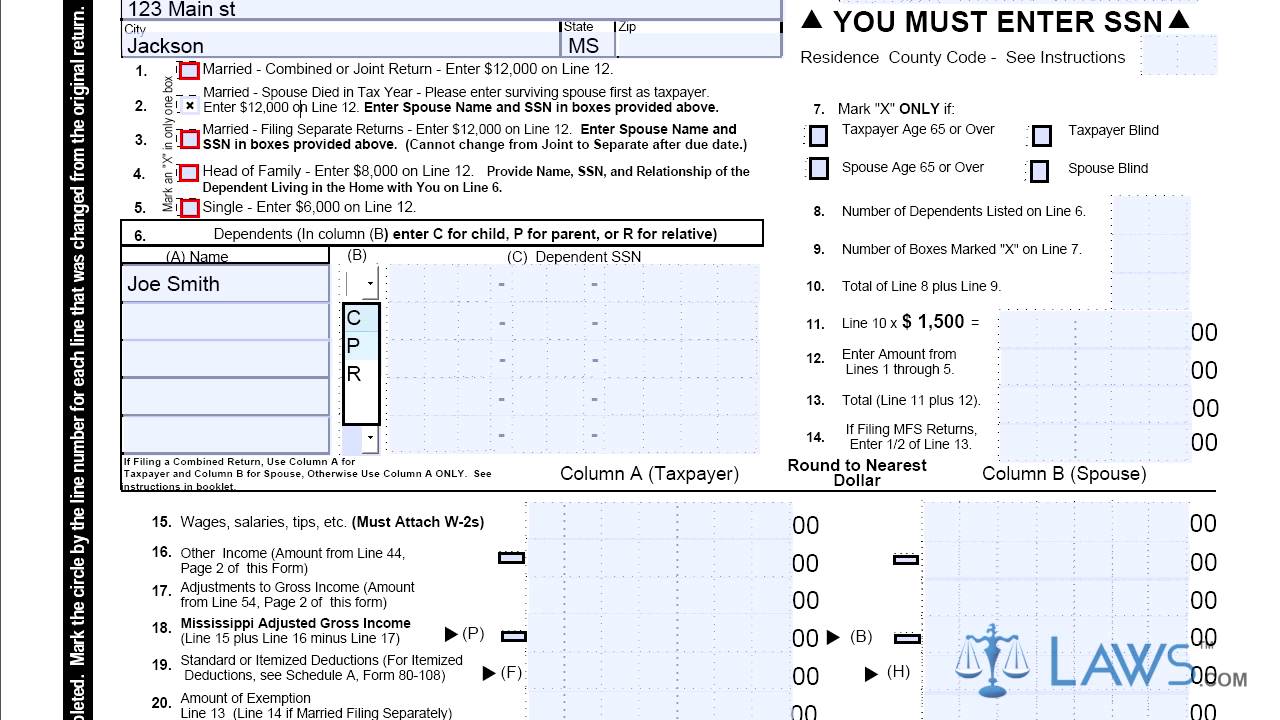

Mississippi Return Review Notice Sample 1

Every State With A Progressive Tax Also Taxes Retirement Income

Mississippi Lawmakers Pass The Largest Tax Cut In State History